Aim for Simpler Value-Added Offerings

For fund and insurance marketers funneling products through intermediaries, value-added programs present a classic “damned-if-you-do, damned-if-you-don’t” situation:

- If You Do: Developing and deploying value-added offerings comes with a big expense and, unfortunately, frequently limited uptake.

- If You Don’t: A lack of value-added offerings means a potential competitive disadvantage and the dangerous appearance of being less-than-committed to help advisors/producers.

So what do we do? Think smaller.

I think part of the problem is that the value-added aspirations of fund and insurance companies are too grandiose. For example, we worked with a top financial advisor this summer: 15+ years of experience, $100M+ in AUM. Among the things we did, the one that made him happiest was the reinvention of his client materials.

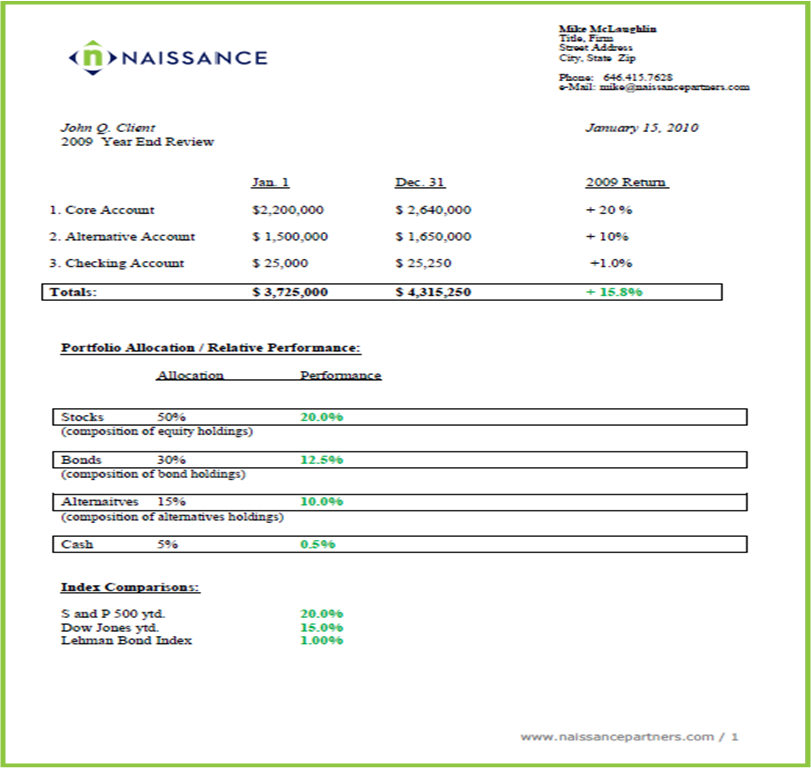

Take, for example, the previous one-page annual review summary (PDF) he used for a $5M+ client*:

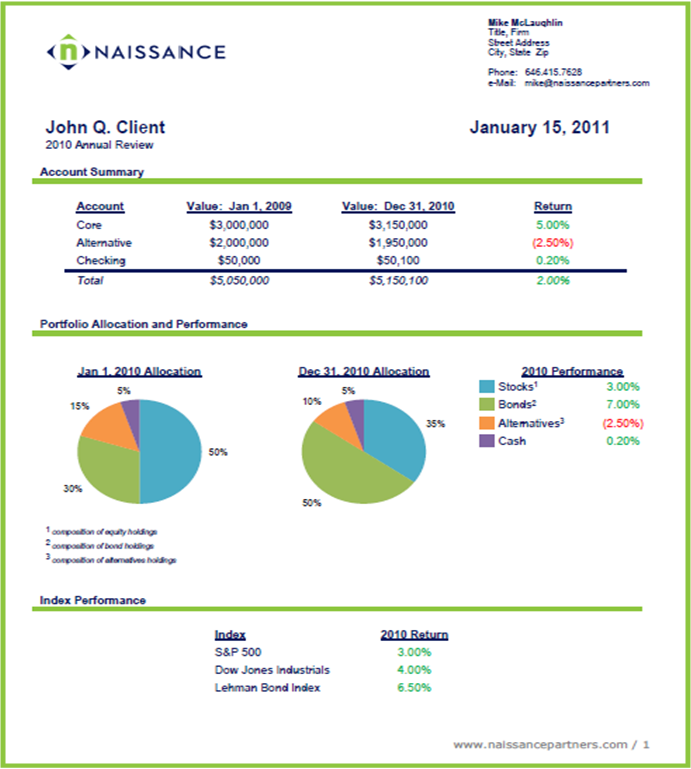

Then consider the updated version (PDF) we provided*:

The use of graphics and clean presentation clearly provides an improvement over the original version. In short order we gave the advisor a template to use as part of the basis of important conversations with his 100+ clients.

Of course there are compliance challenges when it comes to client-ready materials. Even so, many everyday challenges facing financial advisors and insurance producers require relatively simple, straightforward solutions.

So instead of devising a robust, complex program for segmenting client bases, why not focus on simple tools to support the annual review process or offer 5 concise ideas for developing a good introductory presentation? Doing so gives solutions to very common problems. More importantly, this approach fits with the nature of advisors and producers, who usually want quick-wins, not long conversations, from product providers.

The point is: mutual fund and insurance companies can be much more successful with value-added offerings by thinking simple.

* Sample data used. Naissance branding used in place of client branding.