A Sea of Sameness: Marketing Multi-Asset Class Solutions

In recent years survey after survey has shown that both asset managers and institutions alike anticipate significant growth in multi-asset class solutions (MACS). BlackRock has projected MACS to account for 25% of net new business within five years. It’s no surprise, then, that more and more firms (FundFire login required) are investing in their MACS businesses.

However, one element that appears to not be getting enough focus from the industry is the actual positioning and messaging of MACS. So I dissected how 11 high-profile providers initially introduce their capabilities. The result? Differentiated messaging is almost non-existent.

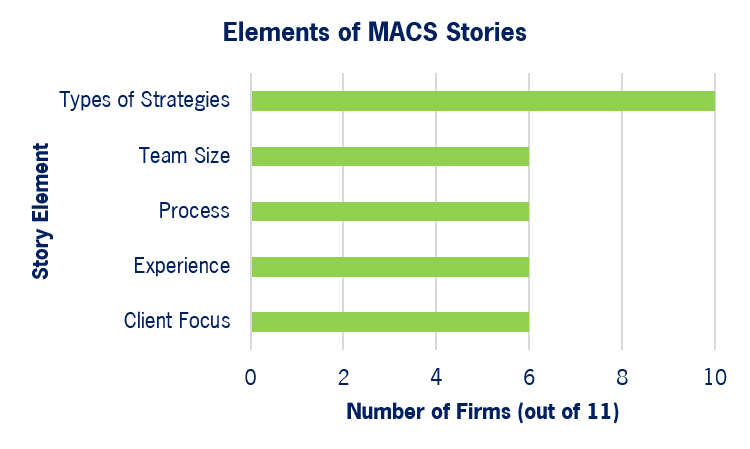

The goal was not to be exhaustive in analyzing the stories, nor to dig through tertiary details, but instead to catalogue the central elements. The sameness across the firms became apparent quickly:

Despite the perceived opportunity, firms repeatedly fall back on consistent elements in messaging MACS. Trumpeting a collaborative process, a focus on client needs, or the size of the investment team does very little to distance one firm from the next.

Of course there are exceptions. For example, two of the firms provide strong specificity on risk management up-front in presenting MACS. But they are the exceptions. And so while there is a major opportunity to pursue with MACS, thus far the marketing does little to reflect that.