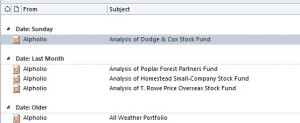

Best Blogs of the Week #193

Greece! Our industry’s bloggers are covering the potential Grexit like nothing ever before. At this (blogging) trajectory, I can only imagine the volume around our US 2016 Presidential election.

By my count, 14 firms dedicated at least 1 post to Greece. Here they are, listed from newest (hence most relevant) to oldest. Only two make an actual prediction on Greece leaving the Europe. Follow us on Twitter to see which two (or read all 14 posts).

- The More Things Change, the More They Stay the Same –Mesirow

- Greece: A resounding “No” to endless austerity –Russell

- Greece Frightenin’ –M&G

- Greece’s Precarious Position –Franklin Templeton

- After the Referendum –Loomis, Sayles (an affiliate of Natixis Global Asset Management)

- Definitive vote ushers in further uncertainty (Greek referendum) –Invesco

- Greece Likely to Exit –Principal Global Investors

- Does Greece Pose a Threat to Global Markets? –BlackRock

- Making sense of Greece’s no vote –Wells Fargo

- Greece Votes “No.” Is Grexit Next? –Oppenheimer

- Greece at Crossroads –JPMorgan

- Reflections on Greece –WisdomTree

- Greece is the Word –Natixis Global Asset Management

- Volatility Futures Suggest Only Near-Term Turmoil From Greece –PIMCO (only post dating from June)