Thought Leadership Arms Race Is On

on May 27, 2015

There’s omnipresent discussion (in the news, from asset managers, by wealth managers) of the 5-year long bull market in US equities. Reading this month’s Mixing It Up from Shefali Anand reminded me about the bull market. There’s another bull market. The asset management industry is experiencing a bull market in thought leadership. It’s easy to understand why: with so many investment options available to financial advisors, thought leadership becomes an important method of building brand recognition and becoming that coveted “trusted partner.”

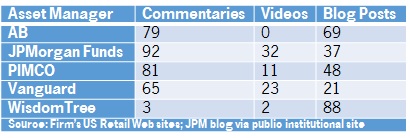

Today, many asset managers are producing thought leadership in quantities never seen before. Let’s just look at 2015 volume to-date from five, well-known asset managers.

What are the obvious takeaways?

What are the obvious takeaways?

- Unless Marketing executives believe thought leadership to be a fad, standing on the sidelines is longer an option. Yet some firms continue to do so, publishing 1 or 2 thought leadership pieces per quarter.

- Introducing and populating a blog with multiple posts per week from different investment team members is no longer optional.