Posted by Anu Heda

on Oct 10, 2010,

in

Thoughts

, tagged with

advertising,

BlackRock,

ETFs,

gold,

iShares

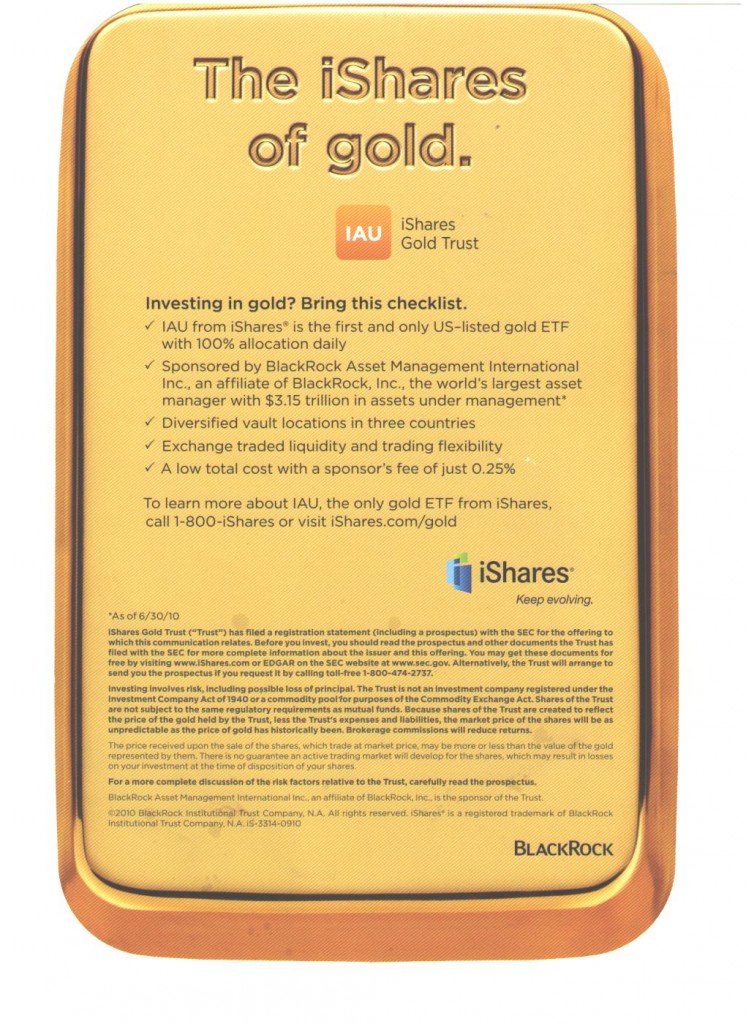

Last weekend, I opened the Sunday paper and the typical coupons and advertisements fell out. There was an unusual one – a full page, heavy-card stock advertisement for IAU. IAU is BlackRock’s iShares ETF that tracks gold’s price. I never received an ETF or Mutual Fund advertisement via the newspaper. I asked Mike, my dad and a friend – to the best of our knowledge; nobody had. Interesting – maybe revolutionary!

The IAU insert from the New York Times. Click to enlarge.

My initial reactions:

- The ad is pretty clear.

- The ad must be extremely expensive.

- The “call-to-action” is pretty generic.

Clarity

The advertisement assumes the viewer is already interested in gold. Then there are five different reasons to invest in IAU over other options. From the advertisement, I think, maybe it’s time to invest in gold and maybe I should do that through an ETF. I wonder if IAU is the best option. My thought process is the best BlackRock can hope for. So, the message is very clear.

Cost

Is this expensive? Expense is relative to value or return; so I can’t really say. Yet, I wonder if BlackRock can measure this ad’s effectiveness. For investors buying IAU via brokerage accounts, there’s no way for BlackRock to measure those sales. Potentially, this advertisement is simply seen as an effort to elevate the firm’s brand and products to a more ‘top of mind’ status. In that context, it’s hard to say if the ad is expensive.

Call-to-Action

The ad lists a telephone number and Web site. I visited the Web site listed (www.ishares.com/gold). I want a continuation of knowledge sharing, instead it’s a bit repetitive. Initially, I see the same bullets; when I click “Learn More,” I’m immediately sent to the Fund Overview page. This Call-to-Action isn’t strong enough.

I’m curious to what you think. Good idea for industry leaders like BlackRock? Does the idea scale down well to other firms?