Digital Fracture: Implications for the Web Site

In a post last week we introduced the concept of Digital Fracture, our term describing the proliferation of technology-driven marketing efforts that are increasingly specialized and disposable. Whereas the proprietary .com was once the overwhelming focus of digital efforts, firms now look at the Web, mobile, and social media as flexible platforms that require multiple, targeted presences.

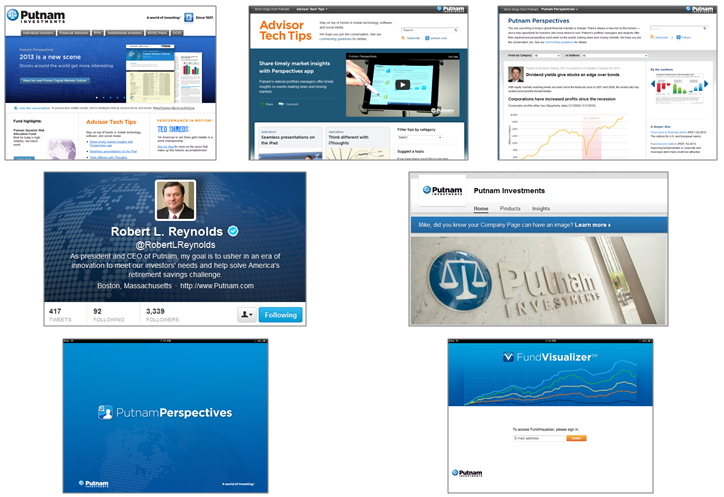

Putnam provides a simple illustration of this trend. Digitally, Putnam not only has Putnam.com but distinct Web sites for thought leadership and advisor technology, numerous social media initiatives, and several distinct mobile applications.

This extension of traditional digital platforms into more targeted marketing is a shift that continues to gain acceptance.

What is driving this trend? Let’s start with the Web site. A central problem with firms’ Web sites is a lack of visibility, meaning that:

- Not enough prospects and clients visit, and

- Valuable content is often lost in the shuffle or hard for find for the people who do visit

So what can firms do? Three options stand out to us as particularly important:

- Broaden Content Distribution: many Web sites rely on their ability to attract an audience and promote content. Some accept material for free (M*, Advisor Perspectives), some are pay-to-play, and some require a PR and relationship-building effort to gain access. Purposefully moving beyond the proprietary site is an important opportunity.

- Embrace Tactical Microsites: differentiated product stories typically do not function within the confines of a banner or online fund profile. As a result, we’re starting to see a renewed uptick in the tried-and-true microsite as a way to give timely visibility and depth to firms’ most compelling product/concept marketing. Two good examples: RidgeWorth on midcap equities, Pioneer on its strategic income fund.

- Improve Search: the vast majority of our clients remain dissatisfied with their sites’ search capabilities. Meanwhile, outside the industry there is continued innovation with tools like Facebook Graph Search and Google Knowledge Search. As these natural language and logical search tools continue to improve, there will be more reason than ever for firms to their own search offerings to make it easier for people to find what they want.

The common thread across these opportunities is that they go beyond “let’s just improve our content, functionality, and design” and reflect the diversity of leveraging the Web beyond the proprietary .com. This combination of breadth and focus is a reflection of Digital Fracture.

Next up: Digital Fracture for mobile and social.