Marketing Alternatives: The Importance of Education (Part I)

First in a series of posts about marketing alternative investment vehicles to financial advisors.

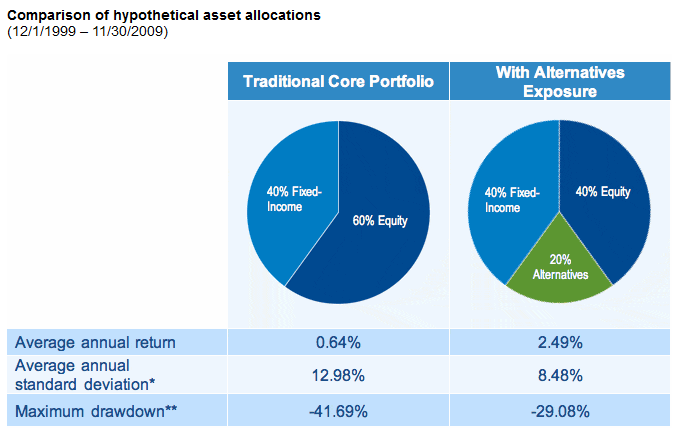

My guess is that the graphic below is (conceptually, if not specifically) familiar to most investment management marketers:

It’s a concise, data-driven way to illustrate the potential benefits of incorporating alternatives into portfolios, namely that alts can:

- Enhance returns,

- Reduce volatility, and

- Improve downside protection

With $120+ billion in assets across nearly 350 mutual funds, the alternative push into the mainstream, specifically aimed at advisors, continues. And this type of educational content has become pervasive. The risk/return angle is often complemented by:

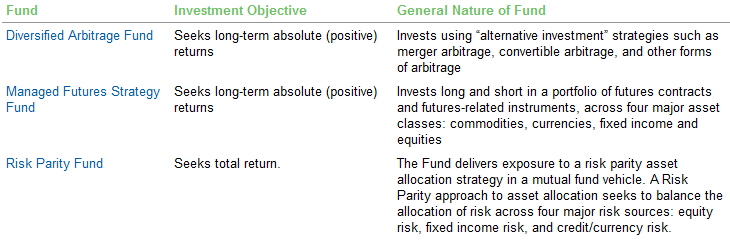

- An introduction to the types of alternative investments

- The importance of extending traditional asset class and strategy diversification

So let’s say you’re charged with marketing new alternative products. How important is selling and educating advisors on alternatives as an asset class? Should you expend significant effort on information that isn’t directly tied to your specific vehicle? How much education is necessary?

I see this is one of the toughest issues in marketing alternatives. The rationale for including educational content has three key points of support:

- Education provides context. The why and how for including long-only, US large cap strategies in portfolios are fully-ingrained in advisors. But that same information is NOT secondhand knowledge for many FAs when it comes to alternatives.

- Distributors want it. Large broker-dealers in particular have been asking for educational support for years. They realize it’s a long, effort-intensive process to get their advisors up to speed on how to effectively incorporate alternatives. And they’re more than happy to share that responsibility.

- Most advisors are dabblers. According to Cogent Research, almost 80% of advisors use some type of alternative product. However, only 15% of FAs allocate more than 15% of client assets to alts. That means many advisors are simply dabblers at this stage, in part because they lack a complete grasp of how alts should be used.

Together I think those points form a strong case. And most firms agree, given their inclusion of educational content in alternative product marketing. That said, if I was launching a new product tomorrow, I’d at least consider skipping over the educational component in my marketing.

I’ll get to why that is next week.