RSS is Hugely Underrated

Yesterday we sent a quick Tweet out to both American Century and Vanguard regarding their blogs. The reason? Neither had the link to the blog’s RSS feed on the blog homepage. We saw this as a missed opportunity. Why do we think that?

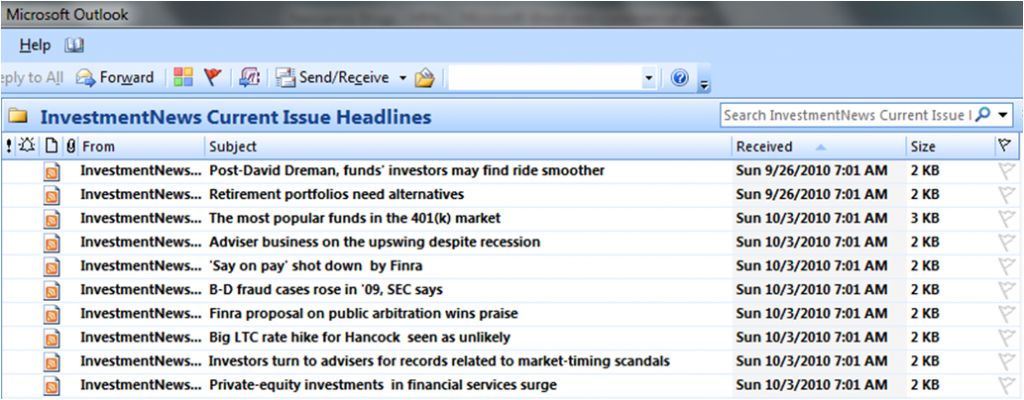

First, let’s take a quick step back. What is RSS? It’s Really Simple Syndication, which I suspect means nothing to many of you. So here’s how I think of it: RSS is a way to browse all of content from all of the Web sites you read every day in a single location. No surfing from site to site. No repetition of clicking links and the Back button, dodging pop-ups and advertisements. If you have Outlook, most of the individual articles/content you care about can be sent directly to your Inbox just like any other e-mail message. Sounds pretty good, right?

Yet, few people actually use RSS. In fact, after 15 minutes of Googling the most recent statistic I can find about RSS adoption is this Forrester study from 2008 that pegs it at 11%. And the news might be worse within financial services. As part of a client project this summer I surveyed 25 financial intermediaries about technology. Only 1 of them had even heard of RSS, and none used it.

There are good reasons why RSS has not lived up to its potential. But that doesn’t mean its promise is lost. A little promotion and simple education is all that’s needed.

For firms like American Century and Vanguard, educating clients about RSS makes sure the people you want to read your content will read it more often. If you are an asset manager or insurer with content and people to reach, education on “what is RSS” can help. After all, someone may not think to visit a blog or Web site regularly, but they’ll definitely be opening their e-mail.

And to their credit, American Century has the RSS icon on the homepage already* and Vanguard indicated they’ll be looking into it.

* It’s possible we went temporarily senile and completely missed the RSS icon on the American Century blog homepage. But two of us spent several minutes explicitly looking for it and never saw it. So, this is our story and we’re sticking to it.