Best Blogs of the Week

This week’s best posts are plastered with great charts and tables. FAs (like all us) gravitate towards them to decide whether we should read this blog post. Additionally FAs can reference these graphs/charts easily in conversations.

- Columbia – Well Zach Pandl (pdf) had us with his first sentence. The post provides insight on a difficult (and common) decision, when to start slowing investment in fixed income, especially government bonds.

- Russell – This post explains a straightforward answer process to the question: how much 401(k) invest is right for me?

- Russell – Any chart that shows returns by asset class is immediately helpful in making the case for a balanced asset allocation model.

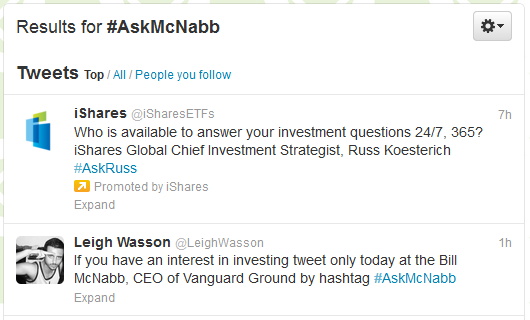

- Vanguard – No surprise that the moral of the story is low-cost and diversified investing. Still the post is effective in supporting that discussion for the thousands of Vanguard-producing FAs.