Best Blogs of the Week #222

Three blog posts this week including big data, intergenerational wealth transfer, and high yield. All three are critically important for financial advisors today and thus important for the companies serving them.

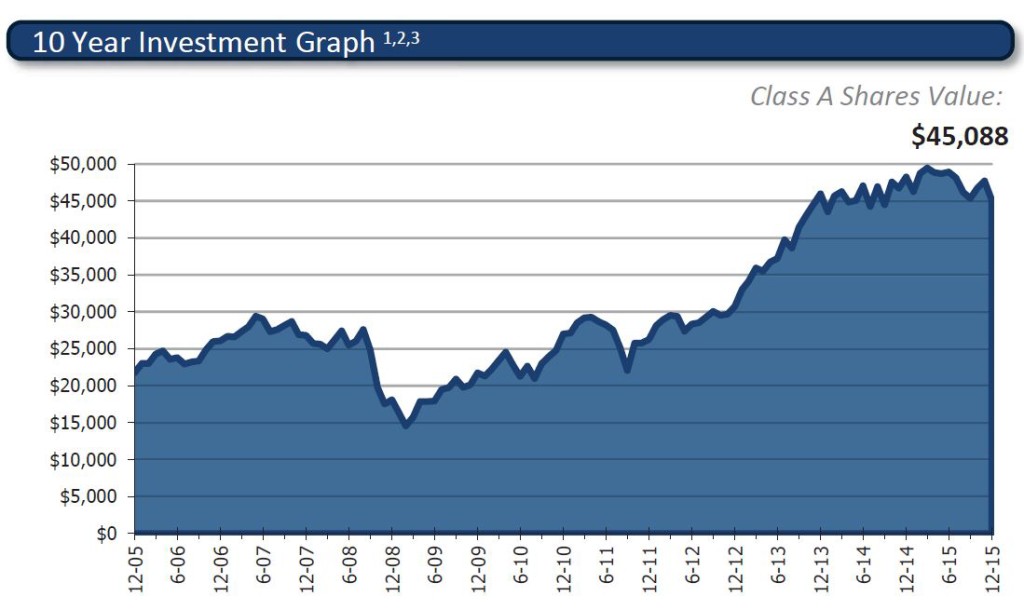

AB – Tuning Out the White Noise in High Yield – This isn’t 2008 all over again. The recent sell-off looks a lot more like what the market endured in 2002.

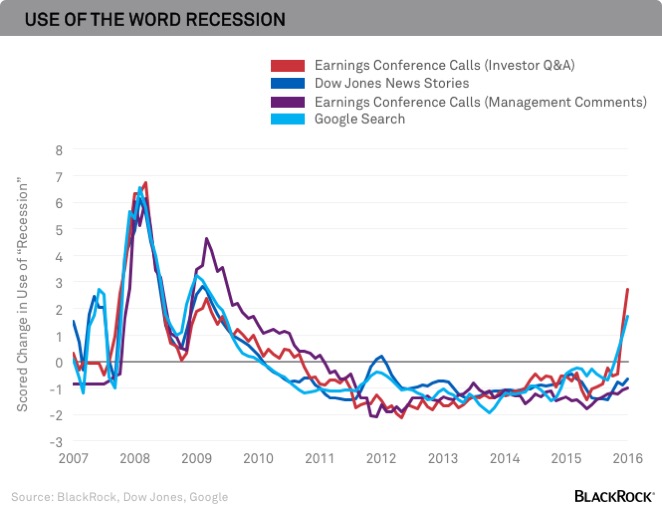

BlackRock – What Big Data Can Tell us about the Economy– Rather than relying on a few anecdotal bits of evidence, big data allows us to measure exactly how much more frequently words like “recession” have crept back into use.

Putnam – Making inroads with the next generation – The biggest obstacle to retaining assets passed to heirs is a lack of relationship.

(Image from aforementioned BlackRock blog post)