Last week I read a Tweet attributing the following to the head of a large mutual fund company:

Compensation structures have to change.

I also recently read a trade journal article about the challenges associated with sales compensation. It covered the usual bases:

- “…firms still fall short when it comes to using pay to incentivize wholesalers to focus on certain activities.”

- “We are looking for individuals who are aligned with the business goals of the organization.”

Here’s how I see it:

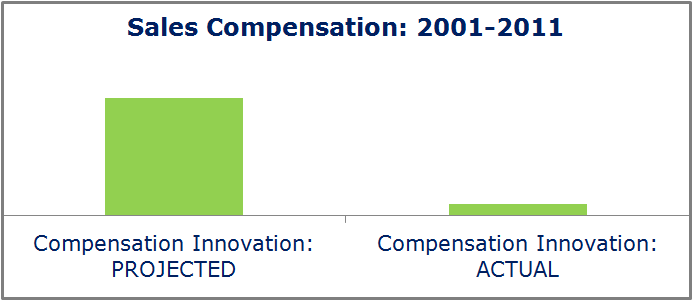

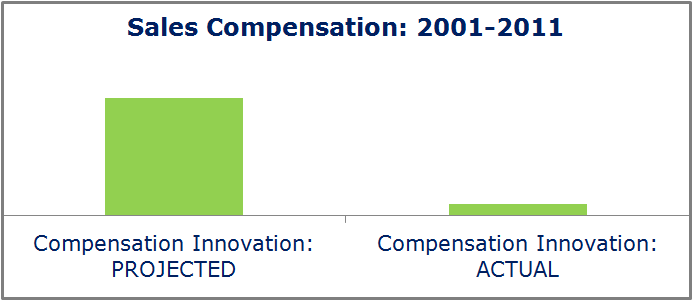

Why? Because of how little the comp conversation has changed over the years. For all the supposed “strategic” conversation around paying salespeople, the last decade has shown comp to simply be an operational tool requiring ongoing tactical adjustments.

The quotes above mirror discussions dating back more than ten years. A quick search on Ignites yielded the following:

- 2010: “…pay models are in flux as firms struggle to offer compensation that can attract and retain key talent but also stand up to bottom-line realities…”

- 2009: “…more companies should consider strategies that align compensation with the overall profitability of the firm.”

- 2006: “…companies are increasingly considering [profitability] when calculating pay packages in order to more closely align wholesalers’ objectives with their own.”

- 2001: “…fund firms should look at bringing wholesaler compensation in line with the firm’s profit model.”

I’m not saying that pay isn’t important – it certainly gets a huge amount of airtime and consideration at our clients. But for now it is not an area that is ripe for innovation. Instead, firms will continue the cycle of making moderate modifications to try and find the right incentives, the right level of complexity, and the right targets.