Best Blogs of the Week #263

Three robust posts from the last two weeks. The quality of charts in asset manager blog posts is dramatically improving as seen in all three posts. I want include the Van Eck and WisdomTree posts not only for the salient point each makes, also to show how product marketing is infiltrating some blogs. It’s an interesting trend occurring at a few of the firms we follow.

AB – Evaluating the Trump Effect on Global Equities – focusing a lens on potential policy outcomes is an increasingly important component for isolating select investment candidates that could deliver solid returns in highly unpredictable times.

Van Eck – Follow the Flows: Active versus Passive – For the three year period ending January 31, 2017, passively managed funds have attracted over $1.4 trillion of new assets according to Morningstar. In that same period, actively managed funds have experienced net outflows of $475 billion.

WisdomTree – An Asset Allocation Study for a Moderate Portfolio – or those willing to alter asset allocations, we believe a continuous improvement in returns per unit of risk could be realized.

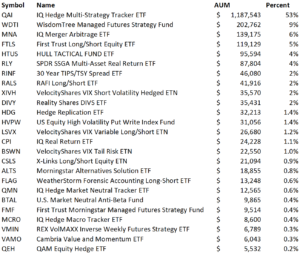

_d3.jpg?uuid=b2e1d42c-ff23-11e6-b39d-76c7e3a9ddf6)