Two Current Marketing Gaps for ESG

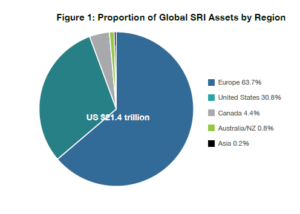

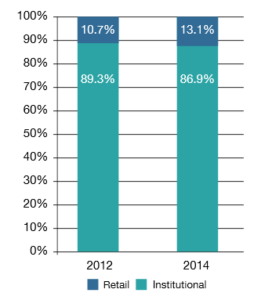

The ESG market is purportedly massive ($59 trillion globally with $6.5B in the US alone). Primarily these assets are held by institutional investors and predominantly in Europe.

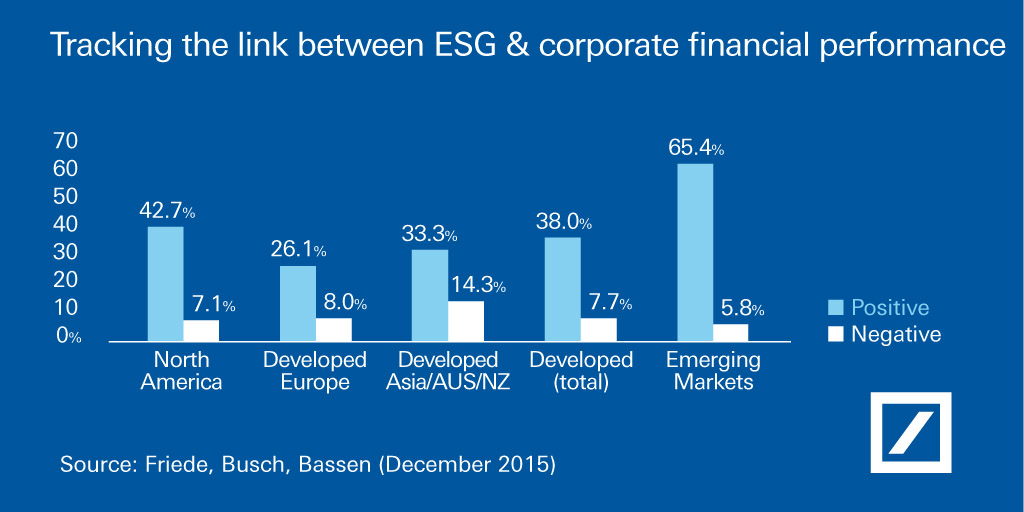

A conventional theory about why ESG hasn’t broken through in the US retail channel states FAs and HNW investors perceive a performance gap versus traditional products. For instance, a 2016 TIAA survey notes over 50% of FAs and investors expect a lower rate of return. However, significant academic research exists dispelling the notion that ESG products have lower rates of return. In a Deutsche Bank examination of academic studies, 89% show highly-rated ESG companies outperform the market. And more recent studies show the performance perception may be changing.

A conventional theory about why ESG hasn’t broken through in the US retail channel states FAs and HNW investors perceive a performance gap versus traditional products. For instance, a 2016 TIAA survey notes over 50% of FAs and investors expect a lower rate of return. However, significant academic research exists dispelling the notion that ESG products have lower rates of return. In a Deutsche Bank examination of academic studies, 89% show highly-rated ESG companies outperform the market. And more recent studies show the performance perception may be changing.

So what’s an asset management marketer looking to communicate its product lineup to do? For firms that have viable products and a desire to promote them, I see two approaches to begin materially-influencing US retail buying behavior.

Address Implementation

The “how” in terms of integrating ESG is often missing in firms’ messaging. There is an opportunity to answer straightforward questions like is ESG a full replacement of all my non-ESG strategies? Is it better to start in one asset class? If so, which one and why?

BlackRock provides a “Practioner’s Perspective (PDF)” that I’d consider only suitable for certain institutional investors and then a glossary of basic terms on their blog. Natixis provides a trio of views on ESG but doesn’t answer these or similar questions. Deutsche Bank shares highly technical implementation via smart beta in their 2013 paper, “SRI Integration via Smart Beta.” These examples don’t really support FAs that may consider integrating ESG into client portfolios.

Provide Examples

Showcasing practical hypothetical examples of how ESG can benefit a portfolio by improving returns and/or reducing risk while positively impacting the broader world enhances clients’ understanding. In essence, consider case studies. A case study can address performance bias or risk considerations or issues such as reducing firearms’ access (USSIF data shows over $350B in policies restricting investments in weapons manufacturing).

These approaches provide showcase whitespace in ESG marketing that may support FAs integrating ESG strategies.

[1] – Top two charts via GSIA (PDF)