A To-Do List for Marketing Smart Beta

Sound familiar?

- A new category of investment products emerges as an attractive alternative to long-established strategies

- Asset managers flood the market with product to appeal to the retail (advisor/investor) market

- AUM takes off, with highly-optimistic long-term growth projections

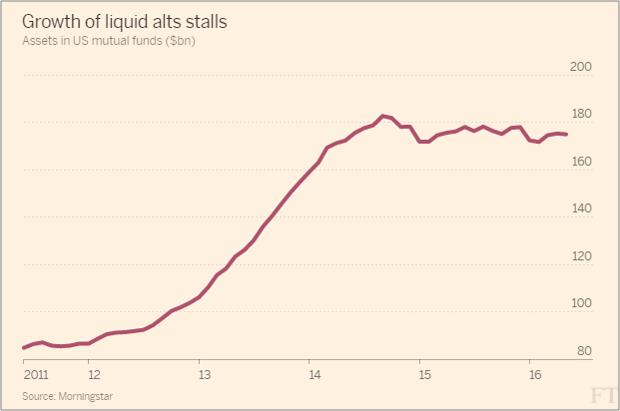

Five years ago this was the storyline for liquid alts. And while the story is far from complete and optimism remains in pockets, the last few years have taken some air out of this high-flying balloon.

Source: Financial Times

Source: Financial Times

The path of liquid alts comes to mind based on the explosion of attention, products, and assets in smart beta. An ETF.com survey showed that 99% of advisors expected to maintain or increase smart beta usage in 2016, and BlackRock recently projected smart beta AUM to nearly quadruple by 2020.

The industry has gotten off to a strong start in marketing smart beta to retail audiences. Education is a central element, and firms have made good progress:

- Establishing ‘smart beta’ as a baseline term, then using proprietary terminology to support proprietary offerings

- Utilizing similar nomenclature and definitions for key factors (e.g., value, momentum, low volatility, etc.)

- Differentiating smart beta strategies in general from traditional active and passive

Of course there is a long way to go with marketing just one of the myriad factors that will impact the long-run success of the category. So what areas represent the next opportunities for improving the retail marketing of smart beta? I see three:

1. Providing Market Context

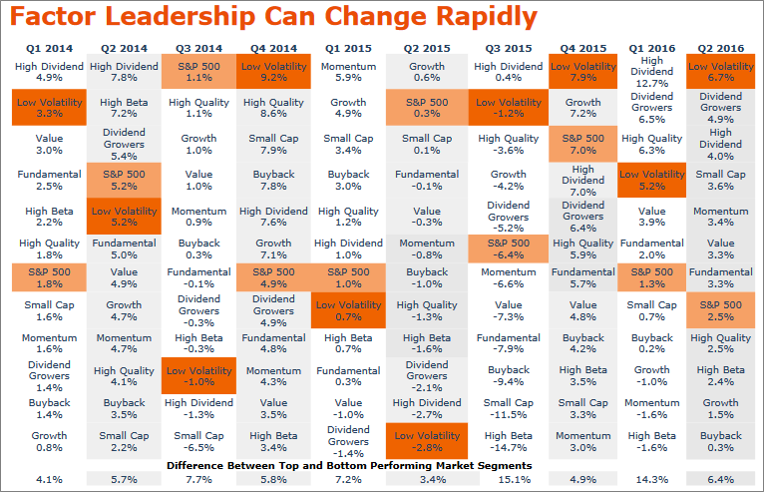

Once the definition of the underlying components of smart beta are understood, the next step lies in helping advisors and investors understand the context surrounding factor performance. This is an important topic in part because of how the outcomes associated with individual factors vary over time (i.e., market conditions).

Source: Invesco PowerShares

Source: Invesco PowerShares

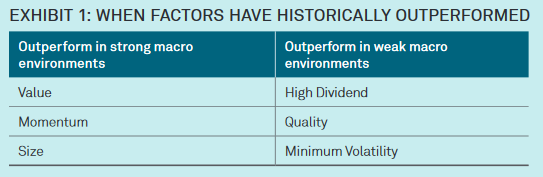

Much in the way we’ve seen asset managers map mutual funds to investor needs and desired outcomes, firms can begin to provide similar context on different factors and factor combinations (and therefore strategies). Even something as high-level as this table from BlackRock gives an advisor or investor a valuable anchor as they learn about smart beta.

Source: BlackRock

Source: BlackRock

The need for context relates directly to the next messaging opportunity – implementation.

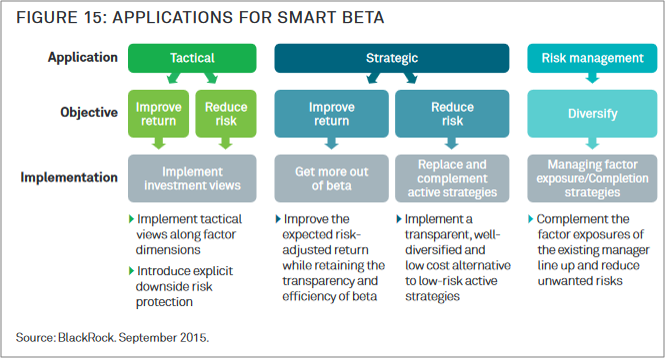

2. Addressing Implementation

Where some progress has been made in putting context around the different approaches to smart beta, firms have been less successful in communicating how smart beta should be integrated into existing portfolios (which is actually something often done well on the institutional side). With liquid alts, most firms started with a simple message that referenced:

- Improving diversification (via assets not correlated with traditional stocks and bonds)

- Targeting a specific (and modest) allocation

A straightforward analog with smart beta is largely missing, and some of the concepts used today are likely too complex for much of the retail market.

Source: BlackRock

Source: BlackRock

Crafting a digestible, clear message on how to apply smart beta will help firms capitalize on the current wave of interest and assets.

3. Clarifying the Brand

I’ve touched on this before so won’t dwell on it here. And while it obviously doesn’t apply to every firm, the many established firms that have recently entered the ETF and smart beta space face a unique challenge in merging this effort with longstanding brand messaging.

As the lines between passive and active investing continue to blur, there’s an opportunity, or more frankly a need, for individual firms to recast how they want to position themselves in the minds of clients. Branding is a long-run consideration, but one that several firms have largely neglected (or deferred) so far.

[ banner image via Stephen Dann ]