100% Alternatives in Your Portfolio. Why Not?

Third in a series of posts about marketing alternative investment vehicles to financial advisors. Click to read Part I and Part II.

What’s a reasonable allocation to alternative investments within a portfolio? Most everyone agrees “more than 0%” is true. After that? Things get foggy.

For an asset manager marketing alternative vehicles, the allocation issue is important. Not only do many advisors struggle to understand alternatives in the first place, but they also have a lot of uncertainty when it comes to implementation.

I started with a simple review of the allocations firms use in materials that introduce alternatives:

- BlackRock’s Investing for a New World sets the initial bar at 15%.

- A Guggeheim (Rydex | SGI) tool implies that the answer is somewhere up to 30%.

- A similar Altegris tool goes further, showing that a 50% alts allocation may improve results.

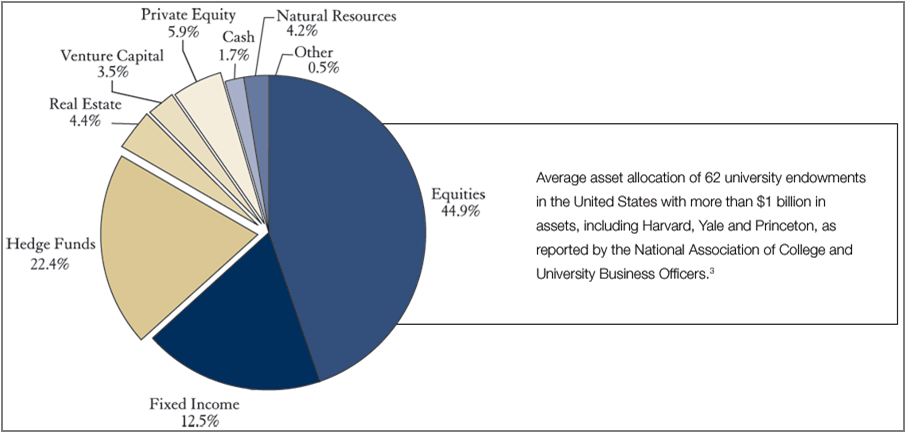

- Raymond James highlights endowments’ 40% allocation to alts, then quickly notes that this is “too high for the majority of individual investors”.

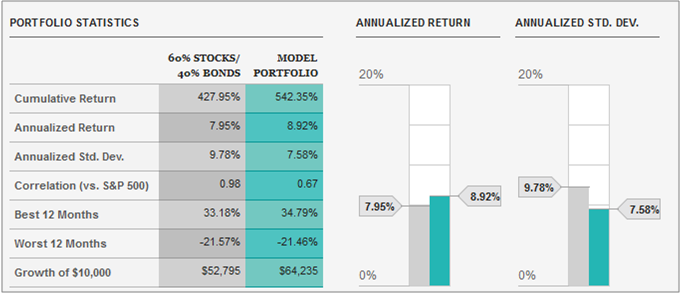

To complicate things, consider yet another tool offered by Hatteras Funds, and what happens if you select a portfolio that is 100% alternatives (the Model Portfolio below):

Now an appropriate answer for allocating to alternative strategies is not just 15%, 30%, or even 50%. Here, a portfolio of 100% alts is the right choice. Confronted with this, advisors or investors are asking: what should I do?

Clearly there’s a lack of consensus. By itself, this lack of consensus is no big deal. After all, the goal isn’t for all firms to have the same perspective on alternative allocations.

The real problem is that firms only provide allocation guidelines implicitly. In the examples above, no rationale or explanation accompanies the percentages of assets that can (or should be) invested in alts. The data does the talking, and it gives a pretty vague (“more than 0%”) message.

I see two paths for firms in resolving this issue:

- Punt on allocation, making it clear that alts have a role and the advisor is in the best position to decide what exposure is best for clients.

- Build a concrete case for a baseline allocation, including the necessary caveats that one-size-does-NOT-fit-all.

Either approach can work, with the key being that the messaging is explicit. Not only will this close a confusing gap in alternatives marketing, but it will help make it clear that providers have a strong grasp on how their products should be deployed.