Best Blogs of the Week #258

Last week ended with the 45th inauguration of an American President. The week was full of blog posts related to the new administration. Last week’s SSgA post kicked off the style and many other managers followed suit. Post types ranged from what to look out for to prognostications. Below are two of the higher impact posts.

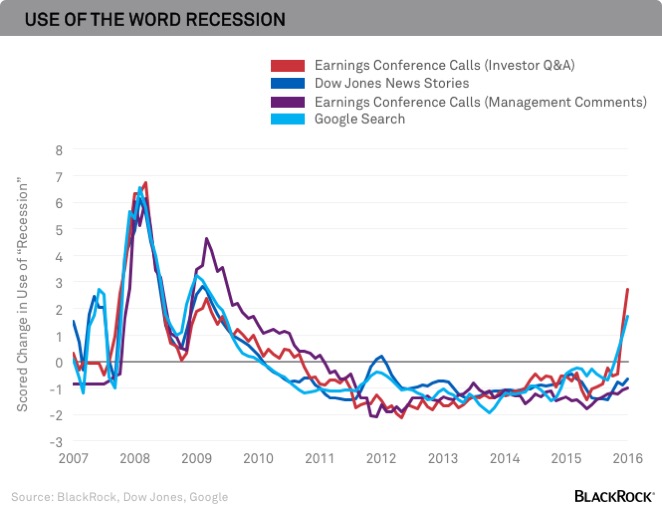

AB – Trump and Asia: Now the Good News – The biggest impact in the short term is likely to be through reflation. Markets have quickly adjusted since the US election in anticipation of higher inflation, partly from Trump’s promise of fiscal measures, such as investment in infrastructure, to stimulate the domestic economy.

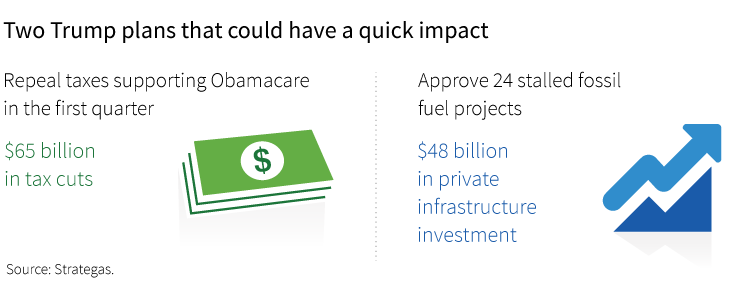

Putnam – Does the market rally really depend on Trump? – We see two forces at work in the rally: First, it reflects an improvement in nominal GDP since the middle of 2016, independent of the policy situation; and, second, it indicates optimism for the new Trump administration’s proposals for tax cuts, infrastructure spending, and regulatory easing.