Twitter by the Numbers

In 2016, there are very few, nearing zero, asset managers without a Twitter account. We follow over 100 asset managers and similar to most users we scan through their tweets at idle moments and occasionally click-through to interesting topics. Given the prevalence and long-standing presence (7+ years in some cases) of Twitter across the industry, a basic question comes to mind: are firms gaining larger Twitter followings? I’ve studied a small set of firms over the last year and arrived at three takeaways. But first, the data.

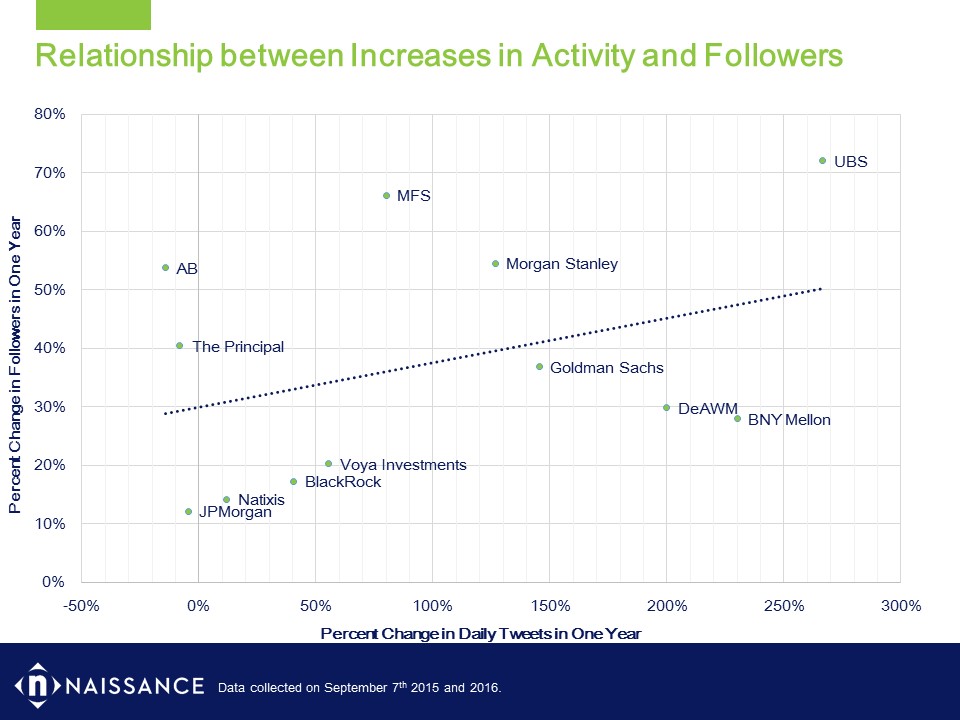

For instance, MFS increased daily tweets by 80% and saw a 66% positive change in followers.

Takeaways from this analysis:

- Nobody has fewer followers than last year, supporting the notion that Twitter (and perhaps all social media tools) has become more valuable for asset managers. Even the three firms that tweet less than they did a year ago have increased followership.

- The industry has not settled on a “normal” amount of activity. Different firms are experimenting with volume ranging from every other day (Deutsche Asset and Wealth Management at 0.6 tweets per day) to every four hours (PIMCO at 6.3).

- In this 13-firm sample, there’s weak correlation between increased activity (via daily tweets) and increased followership. We have no clustering around the trend line.

Note: PIMCO was excluded from the chart for scaling purposes. PIMCO increased Twitter activity by 1,475% and experienced 12% growth in followers.